26 novembre 2025

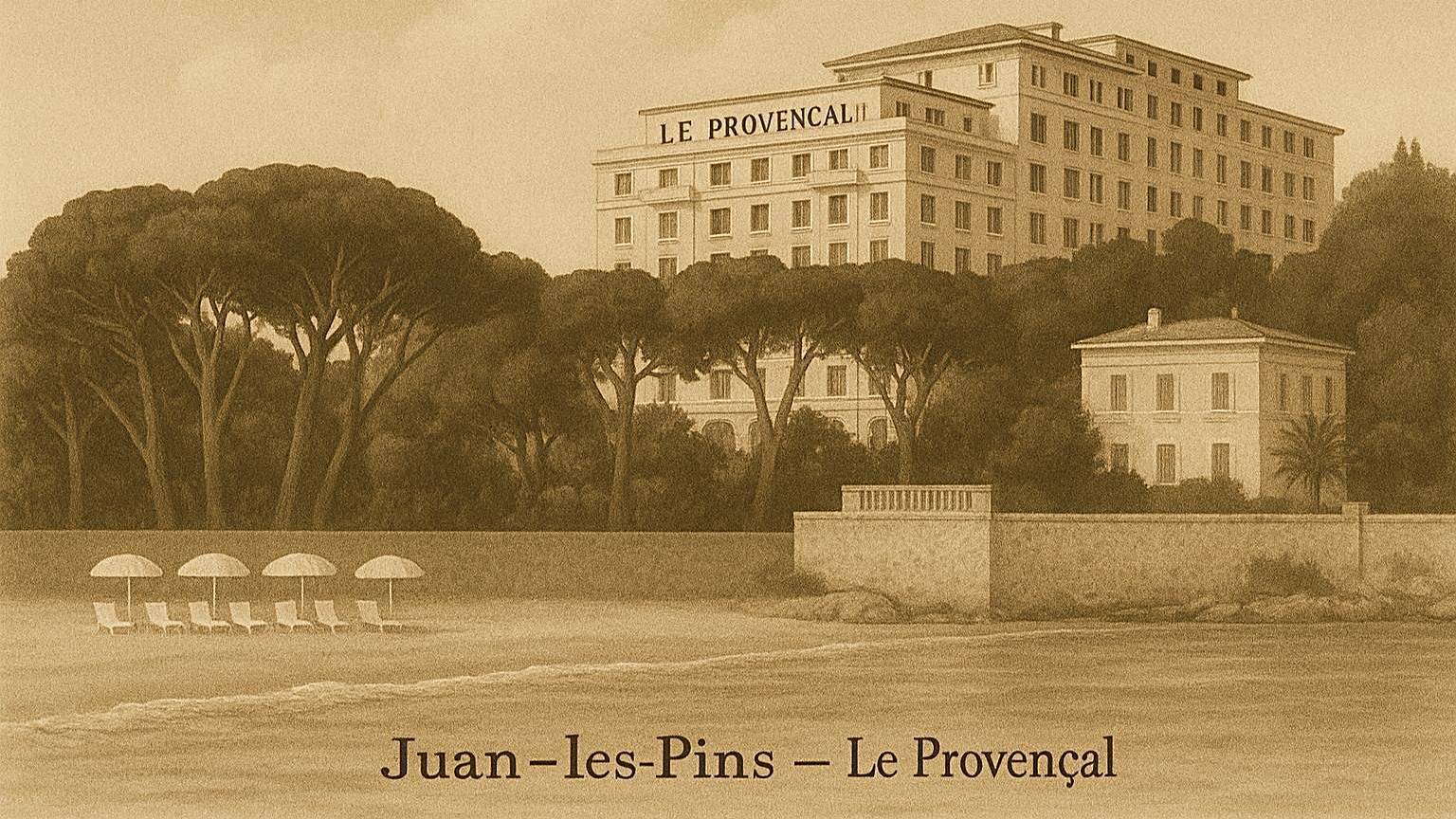

On the French Riviera, certain places perfectly combine heritage and refinement. Le Provençal, a former iconic hotel opened in 1927 in Juan-les-Pins, is a prime example. This legendary address welcomed aristocrats and international figures and remains today a symbol of historic luxury on the Riviera. After several years of renovation, Le Provençal now offers 41 high-end apartments, featuring terraces with views of the Mediterranean Sea. The restoration preserves the building’s Art Deco soul while integrating modern comforts. Future residents will also enjoy Michelin-starred cuisine, a 30-meter swimming pool nestled in the gardens, a sumptuous spa with an indoor pool, and a dedicated concierge service, inspired by the grand hotels of the French Riviera. Located just minutes from our agency, this project perfectly illustrates the opportunities to purchase apartments on the Côte d’Azur in an exceptional setting.

In Nice, Mont Boron hosts prestigious properties that blend history and modernity. Villa Le Roc Fleuri, formerly the home of Sean Connery, is a rare example of a villa for sale on the French Riviera where exceptional heritage meets comfort. The villa offers over 1,000 m² of living space across several levels, with eight bedrooms, panoramic terraces, two swimming pools (including an indoor pool), and a 5,000 m² landscaped garden overlooking the sea. Its history and Belle Époque / Art Deco architecture make this property extraordinary, a testament to Mediterranean elegance and Riviera living.

These properties illustrate the market for prestigious homes and apartments on the French Riviera, where location, history, and quality of amenities are key. Apartments at Le Provençal are offered from €7 million, while Sean Connery’s villa is exclusively on the market for €23.5 million. Whether in Antibes, Cannes, or Nice, these residences provide a glimpse of the exceptional homes available on the French Riviera.

Beyond their real estate value, these properties reflect a unique lifestyle: unmatched climate and light, abundant cultural and sporting opportunities, activities at sea or in the mountains, grand events throughout the year, proximity to Monaco and Italy, and exceptional culinary refinement. Life on the French Riviera is simply exquisite! These aspects allow one to experience the Côte d’Azur at its most prestigious—whether acquiring a house, villa, or apartment on the Riviera, or simply drawing inspiration from the understated luxury and history these properties embody. Two addresses that, each in their own way, showcase the richness of the French Riviera’s real estate heritage and the diversity of its exceptional locations.

---

The French Riviera continues to attract an international clientele seeking second homes. From the incomparable charm of Nice to the elegance of Cannes and the authenticity of Antibes, the region offers a particularly attractive high-end real estate market. Before purchasing a house or apartment in the heart of these iconic cities, it is important to understand the main tax aspects related to owning a property in your personal name.

This tax applies to all property owners, whether it is an apartment in Nice or a contemporary villa in Antibes. On the Côte d’Azur, tax levels vary significantly depending on the municipality, especially in highly sought-after areas.

Although abolished for primary residences, it remains fully due for second homes.

IFI applies exclusively to real estate assets exceeding €1.3 million. Second homes do not benefit from the 30% allowance granted to primary residences. However, mortgages and loans for renovation works can be deducted. An apartment on the Croisette or a house in Cap d’Antibes can therefore easily fall within the taxable base. Our agency guides clients toward specialized tax advisors to optimize and manage the administrative aspects.

Some owners choose to rent out their second home when they are not using it. The Côte d’Azur, attractive all year round, offers a dynamic rental market. Furnished Rental (BIC): ideal for the Côte d’Azur The €72,000 threshold allows the “Micro-BIC” regime:

Before renting, owners must register with the local town hall by completing online form Cerfa 14004*04, which generates an official registration number. As the owner of an apartment in Nice or a house in Cannes, you must collect and remit this tax.

Despite its name, this tax applies to private landlords. It only concerns regular furnished rentals and remains modest. Occasional rentals may be exempt.

When a second home on the Côte d’Azur is sold, any capital gain is taxed at two levels:

Reductions apply over time, leading to full exemption after:

Despite the seemingly high rates, owning a property for more than 5 years grants significant reductions. For example, the purchase price is automatically increased by 22.5% before calculating the taxable gain. As a result, this tax is often limited. Our real estate agency explains the mechanism and can simulate capital gains tax to reassure international sellers.

Purchasing a second home on the Côte d’Azur—whether an apartment in Nice, a villa in Antibes, or a prestigious property in Cannes—involves specific tax considerations. As a dedicated real estate agency, we are here to review, explain and advise you on these matters.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.